2015 Commercial Real Estate Trends

harkins

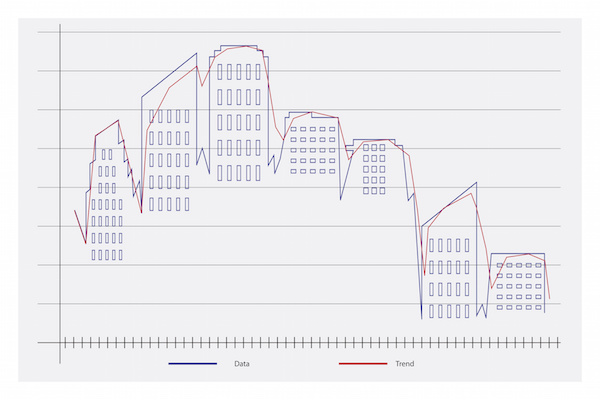

Commercial real estate is akin to the ebb and flow of our ocean’s tide. Trends depend heavily on our country’s economic state. Over the past decade, we’ve seen a lot of change and as a result, here are a few things Floridian commercial real estate investors should be watching.

Renting Space Continues to Reign

Following the recession, rents have remained favorable to commercial entities, while the need to build new commercial properties has been strained by finances. If you’re the owner of commercial property, keep an eye on how fast your vacant spaces fill up, and make sure you’re charging rent appropriately.

Risk Taking is on the Rise

Taking risks on previously untested and undeveloped markets is becoming a new exciting trend. By following jobs and the flow of people, investors have been able to revitalize markets for underserved populations with great success. If you’re able to foresee a commercial need in an area that has no history of that business, the risk may be well worth the reward.

Bifurcation Redefining Retail

As the economy continues its upswing the demand for bifurcated retail areas are increasing. High-end retail shops near grocery and discount department stores in one central area are proving to be very popular. Older and younger people are relocating to urban areas where all their needs can be met in a small radius. Be on the lookout for properties that can serve a wide range of clientele.

The commercial retail markets will continue to change every year and even every quarter. Market trends are as fragile as the economy that makes them. If you have questions about these trends and how your commercial properties can benefit, call Harkins Commercial Real Estate today.

« Previous Next »

Harkins Commercial, Incorporated opened its doors in 1978. Originally conceived as an in-house real estate service for custom home clients of Harkins Development Corporation, Harkins Realty, Inc has today evolved into a comprehensive commercial real estate firm that offers a full range of business-oriented services.

Harkins Commercial, Incorporated opened its doors in 1978. Originally conceived as an in-house real estate service for custom home clients of Harkins Development Corporation, Harkins Realty, Inc has today evolved into a comprehensive commercial real estate firm that offers a full range of business-oriented services.